Whatever It Takes, went the mantra. And it still is the mantra. The problem is that the mechanism has not permitted Whatever It Takes to be implemented. Economic spirits are ebbing away as the logjam in Europe continues. For a while European decision-making was able to look over the brink and act in time. But it is now behind the curve. Recent days have seen commodity prices start to lose altitude. Even the gold price fell as people remembered that an important underpin for gold investors is fabrication demand which takes a large chunk of newly mined gold each year, with China becoming ever-important. Stand by for huge support funds: the ECB will end up buying many billions, even trillions of sovereign debt while the EFSB will have to be boosted to Euros 2 trillion plus. Maybe there will even be a global bail-out with sovereign wealth funds, China, USA, IMF 'n all. But markets are likely to swoon more first because not enough will be forthcoming ahead of the curve. Banking system threat remains on red alert with the risk of spiral into good quality credit rising. Banks have to refinance an awful lot of debt through 2012 and they will be relying on declining collateral quality to do so. This will push up lending rates in a weakening economy. In the meantime we head to Southampton tomorrow to enroll our son into Uni for the first time. There are milestones in life.... The QSL is from BBC Radio Solent, heard in London in 1996 on AM 999. We are looking forward to sailing the Solent soon.

Whatever It Takes, went the mantra. And it still is the mantra. The problem is that the mechanism has not permitted Whatever It Takes to be implemented. Economic spirits are ebbing away as the logjam in Europe continues. For a while European decision-making was able to look over the brink and act in time. But it is now behind the curve. Recent days have seen commodity prices start to lose altitude. Even the gold price fell as people remembered that an important underpin for gold investors is fabrication demand which takes a large chunk of newly mined gold each year, with China becoming ever-important. Stand by for huge support funds: the ECB will end up buying many billions, even trillions of sovereign debt while the EFSB will have to be boosted to Euros 2 trillion plus. Maybe there will even be a global bail-out with sovereign wealth funds, China, USA, IMF 'n all. But markets are likely to swoon more first because not enough will be forthcoming ahead of the curve. Banking system threat remains on red alert with the risk of spiral into good quality credit rising. Banks have to refinance an awful lot of debt through 2012 and they will be relying on declining collateral quality to do so. This will push up lending rates in a weakening economy. In the meantime we head to Southampton tomorrow to enroll our son into Uni for the first time. There are milestones in life.... The QSL is from BBC Radio Solent, heard in London in 1996 on AM 999. We are looking forward to sailing the Solent soon.Current posts on this blog are QSLs (verifications from radio stations) and, often, audio of their station identifications, from around the world. These are mostly stations heard on medium-wave (AM) over long distances, often from Cape Point, south of Cape Town, with my friend, Vashek Korinek. But also included are other QSLs received over a 50-year participation in the hobby, with comments about the station, the area, the politics or the economics.

Saturday, 24 September 2011

Whatever it takes to the Solent

Whatever It Takes, went the mantra. And it still is the mantra. The problem is that the mechanism has not permitted Whatever It Takes to be implemented. Economic spirits are ebbing away as the logjam in Europe continues. For a while European decision-making was able to look over the brink and act in time. But it is now behind the curve. Recent days have seen commodity prices start to lose altitude. Even the gold price fell as people remembered that an important underpin for gold investors is fabrication demand which takes a large chunk of newly mined gold each year, with China becoming ever-important. Stand by for huge support funds: the ECB will end up buying many billions, even trillions of sovereign debt while the EFSB will have to be boosted to Euros 2 trillion plus. Maybe there will even be a global bail-out with sovereign wealth funds, China, USA, IMF 'n all. But markets are likely to swoon more first because not enough will be forthcoming ahead of the curve. Banking system threat remains on red alert with the risk of spiral into good quality credit rising. Banks have to refinance an awful lot of debt through 2012 and they will be relying on declining collateral quality to do so. This will push up lending rates in a weakening economy. In the meantime we head to Southampton tomorrow to enroll our son into Uni for the first time. There are milestones in life.... The QSL is from BBC Radio Solent, heard in London in 1996 on AM 999. We are looking forward to sailing the Solent soon.

Whatever It Takes, went the mantra. And it still is the mantra. The problem is that the mechanism has not permitted Whatever It Takes to be implemented. Economic spirits are ebbing away as the logjam in Europe continues. For a while European decision-making was able to look over the brink and act in time. But it is now behind the curve. Recent days have seen commodity prices start to lose altitude. Even the gold price fell as people remembered that an important underpin for gold investors is fabrication demand which takes a large chunk of newly mined gold each year, with China becoming ever-important. Stand by for huge support funds: the ECB will end up buying many billions, even trillions of sovereign debt while the EFSB will have to be boosted to Euros 2 trillion plus. Maybe there will even be a global bail-out with sovereign wealth funds, China, USA, IMF 'n all. But markets are likely to swoon more first because not enough will be forthcoming ahead of the curve. Banking system threat remains on red alert with the risk of spiral into good quality credit rising. Banks have to refinance an awful lot of debt through 2012 and they will be relying on declining collateral quality to do so. This will push up lending rates in a weakening economy. In the meantime we head to Southampton tomorrow to enroll our son into Uni for the first time. There are milestones in life.... The QSL is from BBC Radio Solent, heard in London in 1996 on AM 999. We are looking forward to sailing the Solent soon.Friday, 16 September 2011

The Swiss hiss

Another global dollar flood! The Swiss National Bank joined with those of the UK, USA, Eurozone and Japan to provide unlimited dollar liquidity for banks in a move reminiscent of the big dollar swap lines that were made available post-Lehmans. It's mostly for Euro banks of course where liquidity concerns have ticked up inexorably in recent weeks. It's not too hard to arrive at the conclusion that many Euro banks are effectively bust on the basis of their increasingly delinquent exposure to the peripheral Eurozone sovereigns. I hate now to be one of the internet economist brigade spelling out doom for the global economy but I have to admit that the policy paralysis is a serious threat. Banks could become seriously unglued. Pumping dollars into the system is merely a stopgap and does not confront the main problem - restructuring of Eurozone debt is now inevitable. In the meantime the Swiss National Bank is aggressively opposing the flow of funds into the country seeking safe haven. The line on Swissy is drawn in the sand but it's tough game to win. The QSL is from from the International Committee of the Red Cross trial in 1968 heard on shortwave in Cape Town in 1968.

Another global dollar flood! The Swiss National Bank joined with those of the UK, USA, Eurozone and Japan to provide unlimited dollar liquidity for banks in a move reminiscent of the big dollar swap lines that were made available post-Lehmans. It's mostly for Euro banks of course where liquidity concerns have ticked up inexorably in recent weeks. It's not too hard to arrive at the conclusion that many Euro banks are effectively bust on the basis of their increasingly delinquent exposure to the peripheral Eurozone sovereigns. I hate now to be one of the internet economist brigade spelling out doom for the global economy but I have to admit that the policy paralysis is a serious threat. Banks could become seriously unglued. Pumping dollars into the system is merely a stopgap and does not confront the main problem - restructuring of Eurozone debt is now inevitable. In the meantime the Swiss National Bank is aggressively opposing the flow of funds into the country seeking safe haven. The line on Swissy is drawn in the sand but it's tough game to win. The QSL is from from the International Committee of the Red Cross trial in 1968 heard on shortwave in Cape Town in 1968.Friday, 9 September 2011

Over-blowing the storm

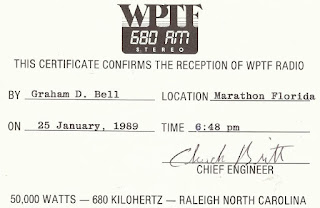

In London for over a week now. But I've spent the last four days travelling around Scandinavia, Germany and Holland seeing clients. The economic environment is pressing down on most fund managers. Market turbulence is very high with big daily moves in indices and stocks. The human mind is not well programmed to deal with constant bad news. Every couple of days I wake up and think: enough of this! There is the temptation to look out and see ordinary people going around doing their daily bidding and think that normality must return, the chaos is not real. But it is real of course. The danger is that politicians in Eurozone and the US may just simply be unable to do the 'whatever it takes' they have promised to do. The mechanics of the political process may not allow it. On the other hand, if the threat becomes cataclysmic, big shifts in political positions could happen quite swiftly. The US is better positioned for this, being a single country. But even the Eurozone may be able to take big steps if it realises that the situation is life-threatening. In the meantime, hurricane activity in the Atlantic has picked up sharply. Irene tore up the east coast, making landfall in North Carolina. The media made an absolute meal of this one, completely exaggerating its severity. So far this season there have been a few more storms than at this time last year but far fewer hurricanes. It's not over yet but the temptation to blow up a storm is higher than ever: Tropical Storm Maria is next. The QSL is from WPTF in Raleigh, NC heard during a business trip to Florida in 1989.

Subscribe to:

Comments (Atom)